UAE Corporate Tax Guide to Registration, Deregistration & Filing Returns

With the UAE government’s announcement of implementing corporate tax starting from the financial year 2023, the tax compliance landscape in the country is poised to undergo a paradigm transformation. Businesses operating in the UAE have been obliged to assess their corporate tax eligibility and compliance requirements such as tax registration, deregistration, filing of tax returns and payment, among other things.

In order to better prepare for the corporate tax compliance requirements, businesses in the UAE can seek advice and assistance from corporate tax consultants in UAE.

This resourceful guide helps businesses in the UAE to easily navigate key corporate tax requirements such as registration, corporate tax filing, documentation and other administrative requirements.

UAE Corporate Tax Registration

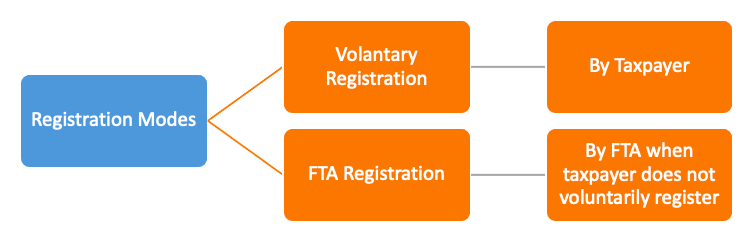

The registration under the UAE corporate tax law can be either voluntary by the taxpayer themselves or the Federal Tax Authority (FTA) also has the power to directly register a qualifying person under the UAE corporate tax law if they fail to register themselves suo-moto, even though they might be so required.

Businesses that fall under the ambit of UAE corporate tax are required to carry out registration with the FTA and obtain the Tax Registration Number within the prescribed period specified by the regulatory body.

UAE Corporate Tax Deregistration

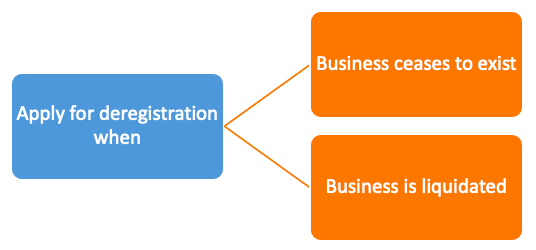

In the event of cessation or liquidation when the business ceases to be subject to corporate tax, they are required to apply for tax deregistration. A deregistration application needs to be submitted to the FTA within three months from the date of cessation or discontinuation.

Deregistration request will be approved by the FTA only if it is satisfied that the business has filed corporate tax returns and paid due taxes and settled all the corporate tax liabilities and penalties (if any) that were due for all periods up to and including the date of cessation.

If a business fails to apply for corporate tax deregistration within the timeframe stipulated by the FTA or fails to comply with the payment and filing obligations, FTA has the power to deregister the business based on the information available at its disposal.

UAE Corporate Tax Return Filing

In order to reduce the administrative burden and costs, eligible businesses have to file only one corporate tax return along with other necessary supporting schedules for each tax period with the FTA. The same needs to be filed electronically within nine months of the end of the relevant tax period.

In the UAE, businesses are not required to prepare and file provisional tax returns or make advance tax payments.

To find out more about corporate tax return filing obligations in the UAE, you may get in touch with corporate tax agents in UAE.

UAE Corporate Tax Payments and Return Filing Deadlines

For businesses having 31st March, 30th June and 31st December as the year ends, the UAE corporate tax payment and return filing deadlines are as follows:

| Financial Year End | First Corporate Tax Period | CT Return Filing and Payment Due Date |

| 30th June | 1 July 2023 – 30 June 2024 | 31 March 2025 |

| 31st December | 1 January 2024 – 31 December 2024 | 30 September 2025 |

| 31st March | 1 April 2024 – 31 March 2025 | 31 December 2025 |

Note: The UAE corporate tax returns must be filed and payment must be made within 9 months of the respective tax period.

Violation of the UAE corporate tax law and rules may attract hefty penalties, which the government may announce soon. Corporate tax advisors in Dubai, UAE will help you to have a proper understanding of the UAE corporate tax compliance requirements to make your corporate tax compliance journey easier and seamless.

Aviaan Accounting – Trusted and Reliable Corporate Tax Consultant in Dubai, UAE

The implementation of corporate tax in the UAE is expected to have a significant impact on the functioning of businesses in the country.

June 2023 is not too far away from now therefore businesses need to gear up in action and carry out high-level assessments and reviews of their existing systems to prepare for the journey ahead.

Aviaan Accounting is a renowned firm of highly skilled Chartered Accountants, tax experts, lawyers and other qualified professionals in Dubai offering corporate tax consultancy and advisory services in UAE.

Our highly qualified corporate tax advisors in the UAE can help you to be better prepared for the new tax regime before it gets implemented, which is crucial to avoid higher implementation costs and to reduce pressure on your in-house tax and finance teams.

We can help your business effectively comply with the complex provisions in the corporate tax regime. Right from the readiness assessment of your busness to the corporate tax implementation process, we support you at every stage of your corporate tax journey.

For enquiries, E-mail: info@aviaanaccounting.com

Related Articles:

How to Register for Corporate Tax in UAE Dubai? A Guide and User Manual

Top ranked 20 Best Corporate Tax Services Consultants in Dubai UAE: Comprehensive-Guide-and-Review

Top Corporate Tax Consultants in Dubai, UAE

List of Corporate Tax Services Firms in Dubai, UAE

Which Entities are exempted from UAE Corporate Tax?

Top 5 Best Corporate Tax Consultants in Dubai, UAE

Public Consultation Paper Summary Corporate Tax UAE

Corporate Tax Consultant in Dubai, UAE

CORPORATE TAX IN UAE – Frequently Asked Questions (FAQs)

Top Best Corporate Tax Impact Assessment Services in Dubai, Abu Dhabi and UAE

UAE Corporate Tax Federal Decree Law (FTA) Summary

What will be the Impact of the Proposed UAE Corporate Tax on Free Zone and Mainland Firms?

What is the Corporate Tax Rate in UAE?

When will the corporate tax be implemented in UAE?

How To Compute Your Tax Liability Under UAE Corporate Tax

Corporate Tax in UAE – How Does It Affect You And Are You Ready?

No. 1 Best Corporate Tax Consultant in Abu Dhabi, Sharjah, Ras Al Khaimah, Ajman, Fujairah

List of Corporate Tax Services Firms in Dubai, UAE

Which Entities are exempted from UAE Corporate Tax?