UAE Guide: Top VAT Consultant in Dubai (2023)

VAT Consultants in Dubai are trained and qualified in the field of Value Added Tax in Dubai. VAT is levied on supply goods and services in Dubai that are governed by the Federal Tax authority. Dubai requires a business to obtain VAT registration and file VAT returns once annual sales exceeds AED 375,000.

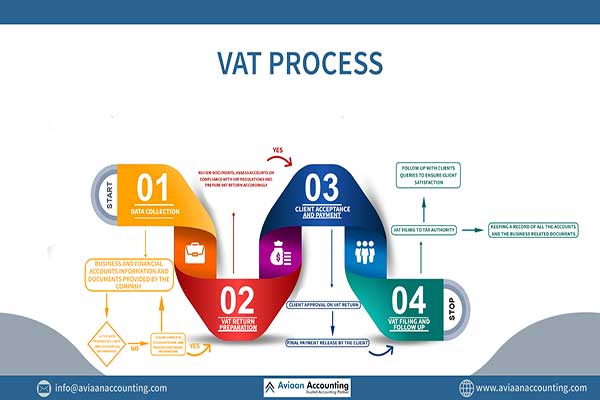

VAT consultants in Dubai provide VAT registration, return filing, audit, VAT consultation, and VAT representation services. Complying with VAT requires businesses to file monthly returns and submit an audit report. VAT consultants in Dubai provide all services relating to the VAT law.

Aviaan Accounting

Aviaan Accounting is one of the leading Vat Consultants in Dubai. They provide services that understand the details of the VAT law in Dubai and ensure companies comply with legal requirements.

Deloitte & Touche

Deloitte’s VAT consultants understand the details of regulations, the importance of industry knowledge, and the growing role of technology. They are a highly accomplished VAT Consultant in Dubai.

Ernst & Young

EY uses new approaches to help the wheels of change turn in favor of their clients as a VAT Consultant in Dubai. They help clients make the right moves with their VAT strategy that helps deliver genuine business value.

KPMG

KPMG VAT Consultant in Dubai advises and implements strategies to help organizations comply with their VAT obligations. They reduce VAT liabilities and particularly for clients without full VAT recovery.

PricewaterhouseCoopers

PwC leads the debate with tax authorities and governments, changing the way we all think about tax. It is a leading VAT Consultant in Dubai in size and scope of its tax practice and reputation.

Why Hire a VAT Consultant in Dubai?

- Globally followed approach for VAT calculation.

- Consulting services are provided suiting the business requirements.

- Local expert about the details of the VAT in Dubai, UAE.

- Advice on how VAT can affect businesses.

- Review the business transactions for VAT compliance.

- Deal with the VAT audits and tax authorities.

- Proper training by the VAT consultants in Dubai to ensure familiarity with VAT processes.

For enquiries Phone (UAE): +971 567952590