Corporate Tax in Dubai, UAE

Traditionally many companies in the UAE benefit from tax revenue on their profits but the Ministry of Finance (MOF) announced on 31 January 2022 that corporate income tax (Corporate Tax) will be established in the UAE with the benefit of the business starting the 1st financial year. June 2023. The UAE plans to impose a 9% corporate tax on business revenue. But they have no plans to introduce personal taxes yet.

WHY IS THE UAE USING COMPANY TAX FROM 2023?

Dubai is a tax-free country. There is not much tax on goods and wages. This practice of taxation is due to the fact that the UAE seeks to meet international standards by reducing the burden of businesses in the UAE and sheltering smallholders.

UAE AIMS FOR CORPORATE TAX:

- To meet international standards of tax transparency and to avoid risky tax risks such as individual commitments.

- Defending their position as the world’s leading business.

- Achieve their goal by accelerating their development to achieve their goals.

CORPORATE TAX WORLD:

The UAE government tax system will apply to:

- The business is involved in the extraction of natural resources. This will remain in place for tax decisions issued by the relevant Emirate.

- This law also applies to those businesses that have a commercial license in the UAE.

- Persons who benefit from their private position (i.e. income, income) as long as the income generating business no longer requires a business license.

- The business of registering a free site will continue to be respected, as long as it complies with all regulatory requirements and does not conduct business in a large UAE country.

- Real Estate management, construction, development, agency services and brokerage (CT also applies to those).

LEVEL:

| Taxable income | UAE CORPORATE TAX rate |

| AED 0 – AED 375,000 | 0% |

| Above AED 375,000 | 9% |

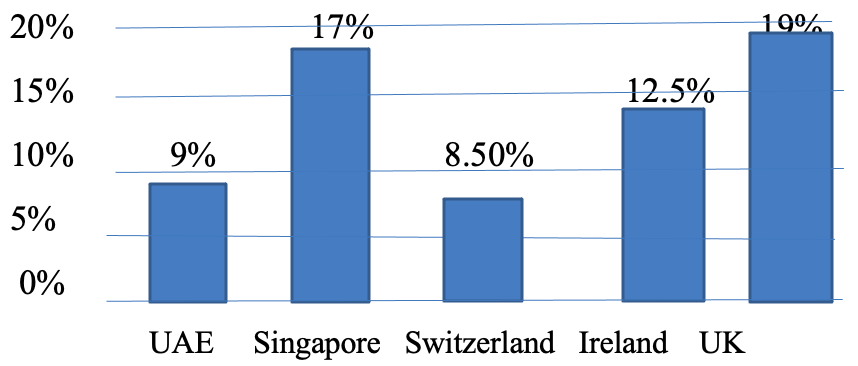

Global Business Hub Corporate Tax Rate

For large international companies a special amount (currently not announced) i.e. a global profit of more than EUR 750m (c. AED 3.15 bn) will be subject to varying degrees in accordance with the rules of OECD Base Erosion and Profit-Sharing.

Corporate Tax BASED INCOME:

- The following types of revenue will be exempt from the Corporate Tax government in accordance with the MOF:

- Full-time UAE companies that perform independent or authorized work, and are listed on Cabinet Resolution.

- Revenue from the extraction of natural resources is not subject to Corporate Tax as these businesses will remain subject to Emirate-level corporate tax (e.g. rising oil and gas companies).

- For-profit organizations and charities such as Dubai care and Takatof mentioned in the Cabinet decision.

- Major shares and profits earned by the UAE business in its eligible shares (i.e., patent-based leisure activity in the UAE or overseas agency) will not be excluded from the Corporate Tax.

- Overseas businesses and individuals who currently do not trade or do business within the UAE continuously or consistently.

- The price range of the subsidy, as it is usually classified as a limited ‘glide-via’ partnership. In addition, regulated subsidies and Housing Investment Trusts may adjust the FTA to exclude Corporate Tax status to meet specific needs.

- Benefits from intra group transactions.

- Additionally, Corporate Tax will not follow up on:

A person receives a separate salary and employment, whether or not it is available from the public or private sector.

- Recreational activities and the various benefits that a man or a woman receives comprise of financial institution deposits or savings programs.

FREE LOCATIONS:

- Free land is an important part of the UAE’s economy and aims to honor its commitment to Free Trade Registration Companies at a rate that those companies no longer doing business on the continent will be difficult to pay a percentage tax (or exempt as it is. Possible) until the end of the holiday period.

- The UAE wishes to maintain its status as a leading regional and metropolitan area and, therefore, the Corporate Tax 0% regime will also apply to trade between Free Zone Persons and their group companies based in the UAE. However, in order to ensure Corporate Tax neutrality in such purchases, payments made to the Free Zone Person by a large national group company would not be a deduction.

- Businesses located in each of the Mainland UAE and Free Trade Areas in addition to those operating under the dual license system should not forget the effect on their operating model.

TRANSFER PRICES TO UAE:

The hiring of exchange rates these days has attracted huge interest rates worldwide due to the growing importance of corporate income tax transfer in the UAE. Now all companies must comply with the Transfer Payment Rules because from now on the OECD Transfer Payment Rules will apply in the UAE and will now be mandatory and may also apply to domestic services.

LOSSES:

- Businesses generally have changes in income levels over the years, and it is not uncommon for a commercial business to incur losses in the first half or due to market conditions. )

- Consultation paper notes that in the event that one person holds more than 50%, tax losses may also continue as long as the same or similar commercial venture is conducted by brand new owners.

GROUPS:

A group of UAE companies can go with it to form a tax group and be treated as a single taxable character, the guaranteed conditions provided are met. The UAE Tax Center will be required to record one refundable tax for every institution. To form a tax group, the agency that determines any subsidiary company may be a single exempt person or an excluded regional business that benefits from a 0% Corporate Tax payment, and all group members must use the same economic year.

Some companies that do not have a 95% threshold Corporate Tax system will allow losses between group companies to produce at least 75% of their own. Estimating tax losses between groups may be allowed.

CONCLUSION:

The applicable Corporate Tax regulation is still being finalized and has not yet been submitted. The arrival of Corporate Tax in the UAE logically follows the role of the UAE as a member of the OECD’s comprehensive framework, especially in the small global tax negotiations proposed using the Pillar II. The 9% placement plan remains highly competitive compared to other areas. It is clear, then, that the Corporate Tax program presented is based on well-known international standards, which make the cost and legal process more efficient compared to businesses under similar jurisdictions elsewhere. It will also be seen that the law preserves some of the UAE’s very different tax benefits.

Aviaan Accounting; Leading Taxation, Accounting, and Consultancy Firm in Dubai, UAE

Our certified and trained attorneys in Dubai, UAE can give you more information about the regulations related to taxation across all Emirates of UAE. You can contact our firm for comprehensive information and legal assistance at info@aviaanaccounting.com or +971567952590.

Related Articles:

Top Best Tax Agent in Dubai, Abu Dhabi, UAE | FTA Approved and Registered

Advantages of hiring Tax Agent in Dubai

Which is the Eligibility criteria and requirements to become a tax agent in Dubai?

Which are the Valuable Assistance Tax Agents Can Add To Your Business in Dubai?