Owing to its economy, which is growing at a fast rate, and its political provisions, which make it easy to set up businesses in Dubai, it has, over the years, come to be known as a business hub. People from all around, from within the United Arab Emirates as well as those from other parts of the world, have come to Dubai in order to set up their businesses/companies since they can be assured of higher profits and returns on their investments here than in other places.

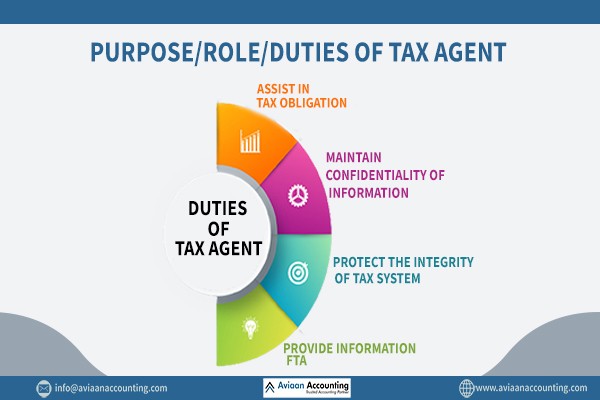

However, while it might be highly profitable to have a business in Dubai, it is important to keep in mind that as a business owner, you are also obligated to fulfill some duties towards the government. You are, as a business, required to pay taxes to the government, and since you are within Dubai, you are also required to charge VAT or Value Added Tax for the goods you manufacture and sell, and ultimately pay that tax to the government as well. Given the fact that VAT in Dubai, UAE is still relatively new in Dubai and that there might always be some confusion surrounding the tax laws or requirements on the part of the companies, it is always better to have someone advise them on such matters, which is where tax agent services in Dubai come into the picture.