Unveiling Your Business’s Worth: Top Valuation Companies in Dubai

Dubai’s thriving business landscape fosters exciting ventures, but when it comes to selling, merging, or acquiring a company, understanding its true value is essential. This is where business valuation services in Dubai from reputable valuation companies come into play.

Why Consider Business Valuation Services in Dubai?

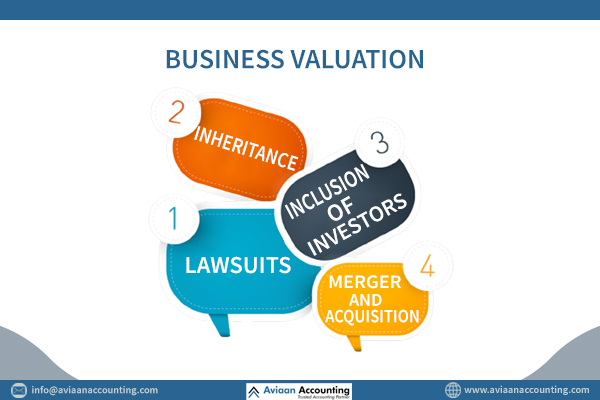

Accurate business valuation offers a multitude of benefits:

- Informed Decision-Making: Knowing your company’s worth empowers you to make well-informed decisions during negotiations, mergers, and acquisitions.

- Investor Confidence: A credible valuation report prepared by a professional valuation company in Dubai instills trust and transparency with potential investors.

- Fair Transactions: Valuation ensures fair deals for all parties involved in a business transaction.

- Strategic Planning: Understanding your business value aids in formulating effective strategies for future growth and development.

Top Valuation Companies in Dubai to Consider:

Several prominent valuation companies in Dubai offer expertise and experience. Here are a few to consider:

- PKF UAE: A well-established firm with a proven track record in valuing companies across various sectors in the UAE. They are known for their sector-agnostic approach and strong technical competence.

- ValuStrat Dubai: Offers a comprehensive suite of services including business valuation, feasibility studies, and transaction advisory. Their team comprises experienced professionals with a strong understanding of the Dubai market.

- Aviaan Accounting: While specializing in audit and accounting services, Aviaan also possesses a valuation team adept at utilizing various valuation methodologies to determine a company’s fair market value.

- KGRN Chartered Accountants: Provides business valuation services alongside other financial advisory services. They emphasize clear communication and client education throughout the valuation process.

Choosing the Right Valuation Company in Dubai

Selecting the right valuation company is crucial. Consider these factors:

- Experience and Expertise: Look for companies with experience in your specific industry and valuation methods applicable to your business.

- Reputation and Qualifications: Research the company’s reputation and ensure their valuation professionals hold relevant credentials.

- Methodology: Understand the valuation methodologies the company utilizes and ensure alignment with your needs.

- Communication Style: Choose a company that prioritizes clear communication and keeps you informed throughout the process.

- Fees and Transparency: Obtain quotes upfront and ensure a clear fee structure.

Types of Valuation Services

Besides Business Valuation, Aviaan through its associates offers following types of Valuation Services:

- Intangible Asset Valuation: This focuses on valuing intangible assets such as intellectual property, brands, and trademarks.

- Machinery and Equipment Valuation: This service estimates the fair market value of machinery and equipment owned by a business.

- Real Estate & Property Valuation: This determines the market value of commercial or residential properties.

- Securities Valuation: This involves valuing stocks, bonds, and other financial instruments.