After UAE, KSA, and Bahrain, Oman has also introduced VAT Law. For all Oman companies, it’s time to take action and be prepared for VAT in Oman transition. VAT Law is generally self-assessed with a high probability of error leading to penalties along with time-consuming interaction with Oman Tax Authority causing business disruption. It is hence imperative that you appoint a qualified VAT Consultant in Oman.

VAT Consultant in Oman

VAT Consultant in Oman

Are you also worried about how your business will adapt to the newly announced Oman VAT Law? Do you need a professional VAT consultant in Oman to manage your VAT related issues?

Aviaan Accounting is a leading VAT Consultant in Oman and understands your concerns. We provide the perfect solution for you including:

- The knowledgeable and experienced VAT team in Oman

- VAT advisory, training, and consultancy solutions

- VAT recording, billing, and payment to Oman Tax Authority

Update on VAT Consultant in Oman Services: Why hire Aviaan Accounting

VAT in Oman is one of the largest sources of revenue for the government and it has specific principles and guidelines which strictly need to be followed by the companies in order to prevent any legal issue. Avian Accounting has expert personnel who will go through every detail of the new VAT Law in Oman and make sure your business does not have to engage in any non-compliance with regulations.

GCC VAT Consultancy experience

- We have years of experience in giving VAT Consultancy services across Oman, UAE, KSA, and Bahrain

- Equipped with expertise in current and prospective VAT account management in Oman

Oman VAT Law

- Possess sound knowledge on legislations and treatment of VAT by Oman Tax Authority

Professional VAT in Oman Team

- You focus your efforts in managing core business activities and leave it on us to oversee and administer all VAT related activities in Oman, VAT assessment, and billing preparations with our superior human capital and technology

- Capable Tax Agent in Oman to help with VAT issues

Value for Money for VAT Consultancy in Oman

- Our VAT consultancy in Oman Fee is competitive, affordable, and value representative.

- Best VAT Consultant services in Oman at a reasonable price

- Timely, customized, and precise work process

Guidelines on VAT in Oman Consulting Services 2021

Our firm provides a complete package of VAT Consulting services in Oman. Our best-in-class specialists and professionals will identify your underlying needs and deliver the best possible VAT Consulting in Oman services. A few of our services are listed below:

- VAT Impact Assessment in Oman

- VAT Implementation Support

- VAT Training in Oman

- VAT Registration in Oman

- VAT Filing in Oman

- VAT Refunds

- Redesigning Accounting and IT system in accordance with VAT in Oman regulations

- Tax Agent in Oman support

- VAT Audit in Oman

Impact of VAT on different Sectors

Oman Economy Sectors | Oman Economy Sectors |

Transportation | International Movement: 0% rated |

Education | All goods and services related to Education are exempted from Oman VAT Law |

Health Care/ Medical | All goods and services pertaining to medical care including medicine, drugs, and equipment are exempted from Vat Law |

Real Estate | Resale of residential real estate: exempted |

Financial Services | All financial transactions are exempted from Oman VAT |

Food and Beverages | Basic food commodities and foodstuff are all exempted from VAT |

Business | Investments in gold, silver, and platinum: exempted |

Corporations are obligated to register for VAT in Oman. All persons to register for VAT in Oman having a place of residence in Oman and handling commercial, industrial, professional, or other activity in Oman with annual supplies that exceed 38,500 OMR. Any person bound to pay tax with no residence in Oman also to register. The process of mandatory registration for VAT in Oman to be done in a phased manner with the opportunity of voluntary registration. Registration for VAT in Oman is done on the tax authority’s website with login at electronic authentication service.

What are VAT Registration Deadlines in Oman?

Mandatory VAT registration in Oman will be in a phased manner spread over a year with 4 phases. Non-residents doing business in Oman can register with the Oman Tax Authority irrespective of any threshold limit. Voluntary VAT registration in Oman to be done by persons having a taxable turnover above 19,250 OMR. Oman Tax Authority advises firms to plan VAT implementation by delegating an expert team including principal personnel from across all core business segments for tracking the progress of VAT preparations.

What is Responsible Person in VAT Oman?

Responsible Person in VAT Oman is any person related to the Taxable Person and represents him in executing the obligations. The Chairman determines the credentials for the Responsible Person in VAT Oman. The Responsible Person can leave Oman for 90 days or less during the Tax Year. If the person wants to stay outside for more than 90 days it can be done by notification to the Authority. The Authority has to agree to appoint another Responsible Person during the entire period of his absence. The duties of the responsible person mentioned in Article 76 of VAT Oman law.

What are Tax Invoices and Records in VAT Oman?

Tax Invoices in Oman need to be issued when making a supply of goods or services in Omani Rials, an option of foreign currency with a condition. Accounting records and books must be regularly maintained and retained as determined by regulations, can be kept in a foreign currency with written approval from the Authority. The accounts of transactions related to supplies of goods and services and the import or export of goods. Tax invoices, accounting records and books, and customs documents are kept for 10-years with an extension of 15 years for real estate.

Tax Representative Services in Oman

Tax Representative services in UAE can help interpret the VAT law, determine the taxes, and file VAT returns in Oman. Hiring a tax representative would make it much simpler to fulfill these legal obligations. The Tax Representative Services is assisting in the submission of VAT returns, liaison with FTA on tax matters, keeping records for clients, VAT registration with FTA, preparation of documents for the FTA during VAT audit in Oman, helping with the submission of reconsideration request on FTA decisions, and proceeding with de-registration for the clients.

What is Tax Return in VAT Oman?

Tax Return in Oman filed within 30 days following the end of a Tax Period. The return shall specifically include details specified by Oman Tax Authority. Revised Tax Return shall be filed by the Taxable Person to the Authority within 30 days following the discovery of error or omission in the Tax Return submitted. The Authority shall adjust the Tax Return if it is made aware that it contains an error or omission or insufficient. They are required to notify the Taxable Person of the adjustment by the Regulations.

What is Taxable Value in VAT Oman?

The Taxable Value is the value that is chargeable to tax. The Taxable Value of Deemed Supply is the value of purchase or cost. The cases, in which the value of cost cannot be determined, will be determined by the market value. The Taxable Value of Related Parties transactions are specified by the regulations, where the value of the supply is less than the market value. The Taxable Value of imported goods is calculated by the customs value prescribed by the Customs Law.

What are the benefits of VAT in Oman?

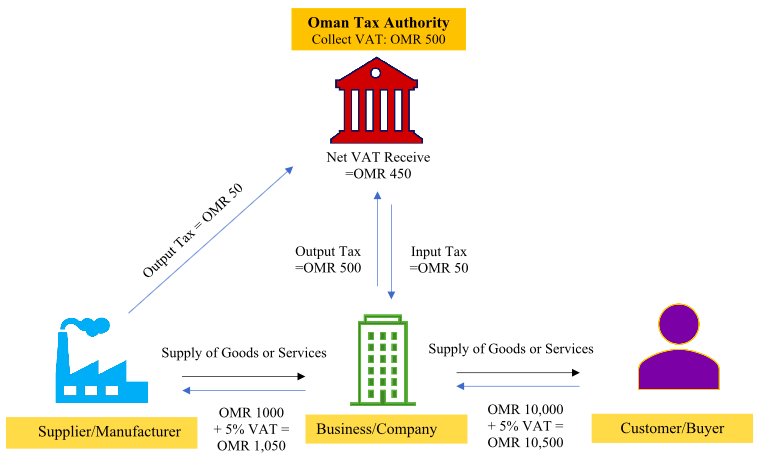

Value Added Tax in Oman is an indirect tax on the consumption of goods and services that is a tax on the value added at every stage of production from the manufacturer to the ultimate consumer. The benefits from the implementation of VAT are diversification of the Oman economy as a whole, encouraging the habit of saving, ensuring the welfare of the Public, no evasion of VAT in Oman after implementation of Oman VAT Law, and higher Living Standards under Oman VAT Law.

VAT Filing in Oman

VAT Filing Process in Oman

The process of VAT return filing in Oman is performed through the online portal of the Federal Tax Authority (FTA) available under e-services. The VAT form provided by Oman Tax Authority for Tax return filing is called Form Tax 201. A taxable person must follow the following action points while filing VAT in Oman:

- The taxpayer individual or business is responsible to submit a Tax return in Oman in the prescribed format given by the FTA.

- Every taxable person and business has to submit the VAT Return within 28 days from the end of each Tax period prescribed by the FTA.

- The taxable person is also liable to remit the amount of tax due to the FTA within 28 days from the end of each tax period.

Pre-requisite for VAT filing in Oman

The Federal Tax Authority of Oman encourages businesses to properly plan their VAT implementation projects. Given below are the few steps which a taxable business can take as a pre-requisite for filing VAT in Oman:

- Identify the financial and other impacts of VAT on all business transactions, including whether those transactions should be treated as standard-rated, zero-rated or exempt

- Assess the impact of VAT on product or service pricing

- Develop a roadmap of all tasks required in order to be ready for VAT

- Conduct VAT awareness workshops for employees and external stakeholders

- Update IT system accordingly

- Ensure the business is able to produce sufficient tax reports in order to prepare and support periodic VAT returns.

Furthermore, while filing VAT return, the form must include the following points:

- Accurate value of taxable supplies and exempt supplies.

- Correct value of imported goods.

- Precise value of Output Tax for which the VAT return is prepared.

- Precise value of Input Tax claimed.

- And the value of Tax due during the Tax Period for which the return is prepared.

It is also to be noted that in case the VAT return in Oman is not submitted within the specified time, then FTA has the right to assess the Tax for the Tax Period, and notify the taxable person or business of the assessment in accordance with the Oman VAT Regulations.

Document Required for VAT Filing in Oman

Every registered taxable person and business in Oman must have to manage and maintain proper records including:

- Details of tax invoices

- Customs documents

- Accounting books

- Import and export transactions

All the accounting records and books must be maintained in the local currency that is Omani Riyal. The taxable person can maintain accounting records or books in a foreign currency after receiving written approval from the Tax Authority.

The Taxable Person or business in Oman shall retain tax invoices, accounting records and books, and customs documents related to the import and export of goods and any other documents that are related to specific tax returns submitted to the tax authority for the 10 years following the end of the tax year in which tax return was filled. For the real estate section, the time period is 15 years.

FAQs

VAT will be implemented at a standard rate of 5% in Oman. It will be payable to Oman Tax Authority periodically

All registered companies must retain normal VAT records and books of accounts for a standard period of 10 years and an extended period of 15 years.

Oman has four free zone areas, each targeting a different sector, which are of great importance to investors because of the tax-free provision. However, only those sectors will be exempted from Oman VAT which is announced by the government as Designated Zones and will be treated in accordance with Oman VAT regulations.

This note is issued by the supplier of goods and services explaining in detail the deduction made on the original price of the supplied material.

Value-added tax can be claimed and recovered by the taxpayer from the tax authority under specific principles and provisions of Decree-Law.

It means the company which imports goods or to whom goods are being supplied.