Oman Guide: VAT Return Filing Services In Oman

Businesses registered under the Oman VAT law are required to submit VAT returns to the TA or Tax Authorities in a prescribed manner. The VAT return happens to be the statement summarizing the details of sales, purchases, recoverable input VAT, output VAT, etc. Businesses require submitting these documents in order to submit to Oman’s tax authorities.

The periodicity of the VAT return happens to be quarterly. Businesses are required to file their return within a total of 28 days following the quarter’s end.

Businesses must submit their VAT Return in Oman digitally through its online portal as prescribed by the tax authorities. Oman VAT Regulations have the compulsory information required for getting declared by the registered individual in the form of VAT returns.

What Should You Include In The VAT Return Form in Oman?

Given below are the details that you require including in the VAT return form:

- Details of the taxable individual: Business such as the business name/ legal name/ trade name/ and more

- TIN or Tax Identification Number of the business: It must get issued after the VAT registration

- Tax Period: The VAT return period is quarterly for which the return gets submitted

- Value of the taxable & exempt supplies: All domestic supplies on which a total of 5% VAT gets applicable (also, summarizing details of exempt supplies during the period of the tax)

- Value of imported goods

- Value of Output Tax

- Value of Input Tax

- The value of tax due during the period of tax reporting

- Details determined by TA or Tax Authority

According to VAT Return Filing Services in Oman, tax return form is referred to as Form Tax 201. The taxable individual is responsible for submitting the Tax return in Oman in a prescribed format by FTA. Each taxable person needs to submit Tax Return within a total of 28 days from each Tax period’s end prescribed by FTA.

It must get carried forward with regard to the provisions of the Tax law in Oman. The taxable individual is liable to remit the tax amount due to FTA within the specific time frame given by the Oman Tax Law.

How Aviaan Assists You With Tax Return Filing in Oman?

Aviaan’s tax professionals support customers in a number of areas. The professionals understand how to deal with the business. That’s why they set accounts, taxation, and even financial domain. They develop services and help customers for filing tax returns in Oman.

From reviewing to verifying the selected sample Tax based transactions, they ensure that the right correct Tax amount gets charged on the sales as Output tax. They also ensure that the correct tax get charged by the supplier as claimed or accounted.

The VAT experts in Oman perform random review of the important document maintenance as per guidelines offered by the FTA or Federal Tax Authority in Oman. It ensures that the compliance gets adhered with. Finally, they also ensure that the Tax returns get filed within a specific time in every tax period.

Importance of VAT return filing in Oman

The significance of VAT return filing in Oman cannot be ignored especially for the government. It helps the Omani government to generate enough income for the smooth operations of various public sectors. It also helps reduce the dependence on oil reserves of the country. This is a better alternative to just relying on the natural reserves of the country.

Guidance on VAT filing in Oman

VAT filing in Oman is not applicable to all individuals or businesses, there are few exemptions announced by the government regarding VAT return filing. In real estate, the supplies for commercial construction are VAT applicable; however, the supplies for residential construction are VAT exempt. There is a separate section of zero-rated goods/supplies which includes health and education goods and services.

VAT return filing Mechanism in Oman

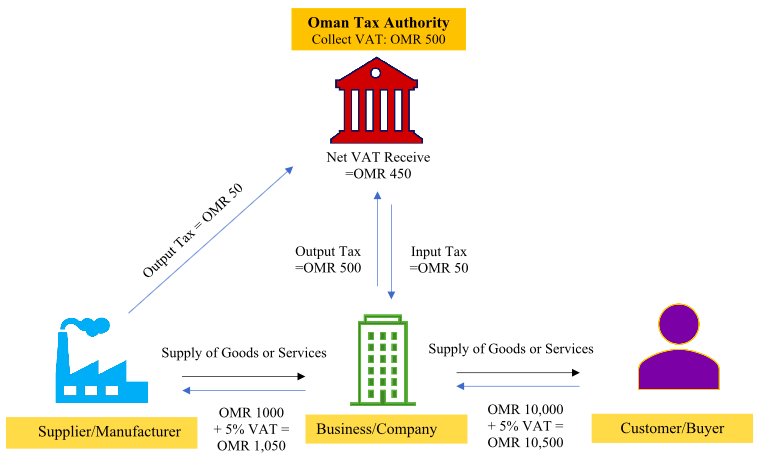

Given below is the basic flow of how VAT collection and VAT filing work in Oman:

- Every taxable business or individual who makes earnings of OMR 35,000 annually is required to register for the VAT collection. However, for those who are earning more than OMR 19,250 for now, it is optional; they may choose not to register for VAT.

- Once a business is registered with the Ministry of Finance via the online portal, all business transactions with end consumers contain the 5% VAT at each stage of the supply chain.

- The tax is paid to the supplier by the business on behalf of the end consumer, and the tax is collected from end consumers on behalf of the Omani government.

- At the end of tax year, the business is required to file VAT return to consolidate the amounts paid to different stakeholders.

- Based on the consolidated numbers, either the business pays a differential amount to the government, or the subsequent payment of VAT is adjusted if the business has already paid more than the actual numbers.

VAT filing Services in Oman

Aviaan Accounting provides an exceptional VAT return filing service in Oman. We are equipped with a highly experienced team of professionals who have knowledge and expertise in various fields of taxation. VAT filing is a new concept for companies operating in Oman, thus we offer our experienced VAT filing service to the businesses in need.

Business entities in Oman need tax professionals who can provide a combination of local attention and global capabilities. Our tax professionals can provide you with the necessary proactive advice and support. We play an effective role in strategic business planning while considering and incorporating VAT laws and regulations. We provide a full range of VAT return filing services for those whose talent mobility strategy requires the relocation of individuals to other tax jurisdictions. Our team of experienced tax professionals takes the time to understand your unique tax position and customize VAT filing services in accordance to client requirements.

For enquiries, E-mail: info@aviaanaccounting.com

Related Articles:

How does Oman VAT Law impact Real Estate Sector?

What is Zero Rated and Exempt Supply Under VAT in Oman?

How to De-register for VAT in Oman?

What Is The VAT Impact On Precious Metals Sector In Oman?

What Is The VAT Impact On Food & Beverages Sector In Oman?